Case Study

Automating Chargebacks with AI for

Metawin Inc Company

From validation to document generation, our AI agent handles 1,000+ daily chargebacks in minutes - saving your company time, money, and resources.

Automating Chargebacks with AI Agent for Metawin Inc Company

Initial Problem

The company faced a significant challenge handling an average of 700 chargebacks daily. Their manual processing system struggled to keep up, leading to a backlog of unresolved disputes. Despite a dedicated team of analysts, they could only process a fraction of the cases on time, resulting in a success rate of just 30% for chargeback recovery.

The accumulated backlog and inefficiency were causing millions in unrecovered losses, operational strain, and weakened relationships with acquiring banks. Moreover, creating representments (chargeback responses) was so time-consuming that many cases were abandoned due to missed deadlines.

Solution Implemented

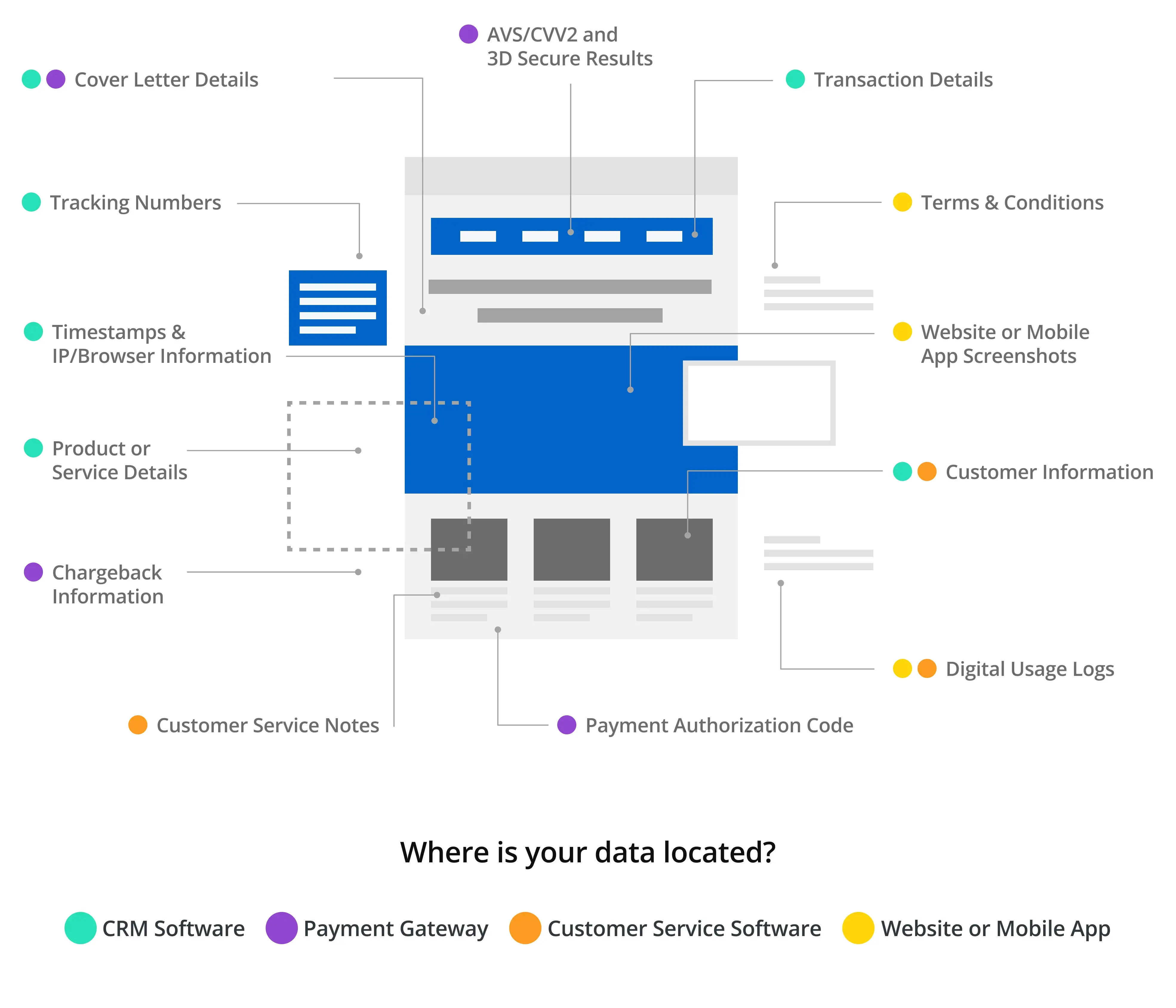

The company deployed the AI Agent Chargeback from Aigent Data to fully automate the chargeback process. The solution provided the following key features:

Real-Time Chargeback Analysis:

- The AI Agent automatically reviewed and classified all 700 daily chargebacks, identifying fraud patterns, processing errors, and legitimate disputes in real-time.

- Extracted critical data from transactions and matched it against merchant agreements to assess the feasibility of each representment.

Automated Representment Creation:

- Generated comprehensive and compliant representments, using supporting evidence like transaction records, terms of service, and receipts.

- Ensured compliance with the specific requirements of each acquiring and issuing bank.

Optimized Decision-Making:

- Leveraged machine learning to prioritize high-potential cases, maximizing the recovery rate.

Results Achieved:

- Complete Daily Processing: The system processed and resolved 100% of the 700 daily chargebacks, eliminating the backlog entirely.

- Significant Cost Savings: The company reduced its team of 20 analysts to 5, reallocating resources to strategic initiatives.

- Increased Success Rate: The chargeback recovery rate improved from 30% to 75%, resulting in an estimated $1.2 million annual savings in recovered losses.

- Faster Response Times: Representment submission times were reduced from 7 days to less than 24 hours, strengthening the company’s relationships with acquiring banks.

- Enhanced Scalability: The AI Agent seamlessly scaled operations, ensuring consistent performance even during seasonal spikes in disputes.

Conclusion: The AI Agent Chargeback from AigentData revolutionized the company’s chargeback management process by automating manual workflows, eliminating backlogs, and significantly improving recovery rates. This transformation allowed the company to save costs, recover more revenue, and strengthen its competitive position in the financial services sector.

Conclusion

The AI Agent Chargeback from AigentData revolutionized the company’s chargeback management process by automating manual workflows, eliminating backlogs, and significantly improving recovery rates. This transformation allowed the company to save costs, recover more revenue, and strengthen its competitive position in the financial services sector.

Launch with ease

Experience AI in Action:

Book Your Personalised Demo Today

See how our AI agents can revolutionise your business with automation, seamless customer interactions, and powerful integrations.